Introduction: Why Token Supply Models Matter

Launching a token in the rapidly evolving Web3 landscape can be a game-changer for businesses looking to build loyal communities, offer new incentives, and drive engagement. But among the many elements that make up a token’s design—utility, governance, branding—one factor underpins them all: token supply.

Modeling a token’s supply can dramatically influence its perceived value, market behavior, and overall adoption. This is especially critical for Web3 marketing agencies that aim to leverage tokens to attract and engage users, foster loyalty, and create vibrant communities around products or platforms. Whether you’re entirely new to blockchain or an experienced professional, understanding how supply models work and their real-world impact can help you create a more compelling and sustainable token-based strategy.

In this blog, we’ll explain fixed, inflationary, and hybrid supply models, explore their pros and cons, and provide actionable insights into how they impact value and adoption. By the end, you’ll know how to choose (and market) the right token supply model for your project.

Web3 Marketing Basics: Engaging Users Through Tokens

Before diving into the specifics of supply models, let’s address why tokens are such a powerful tool for user engagement:

- Alignment of Incentives

- When you distribute tokens, you effectively turn users into stakeholders. As the project grows in value, token holders benefit, creating a natural alignment between the project’s success and user engagement.

- Community Building

- Tokens can act as “membership badges,” granting holders access to exclusive features, voting rights, or premium content. This sense of exclusivity fosters loyalty and promotes active participation.

- Gamification and Rewards

- Whether it’s airdrops, staking rewards, or NFT collectibles, tokens add a gamified layer to the user experience. This can spark interest and encourage users to contribute or hold over the long term.

- Fundraising and Bootstrapping

- Many projects launch with a token sale—like an ICO (Initial Coin Offering) or IDO (Initial DEX Offering)—to raise capital while simultaneously bootstrapping a community of early adopters.

In short, tokens are not merely “digital assets.” They are strategic vehicles that can transform passive users into engaged community members. However, the choice of how many tokens exist (and how they are minted or burned) goes hand in hand with how effective those tokens will be in driving adoption and loyalty.

Token Supply Models Explained

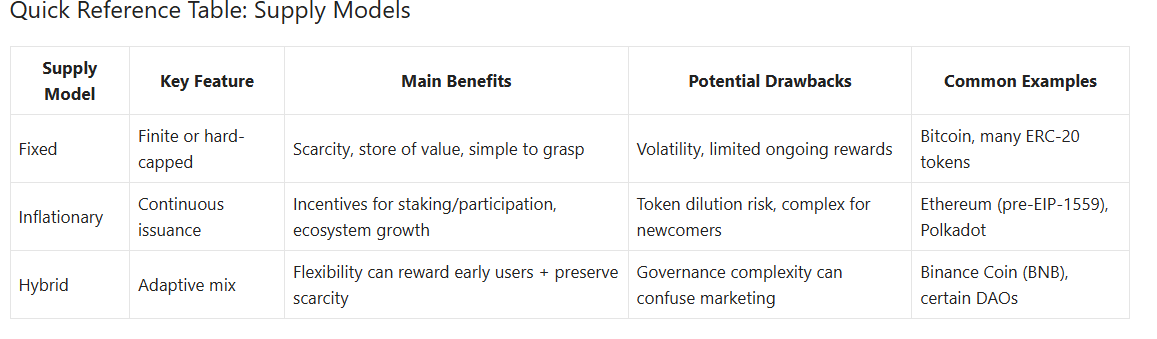

In tokenomics, supply refers to the total number of tokens that can—or will—exist within an ecosystem. While many variations exist, most supply models fall into three primary categories: Fixed, Inflationary, and Hybrid.

1. Fixed Supply

A finite cap on the number of existing tokens defines a fixed-supply token. Once that cap is reached, no new tokens can be minted. Bitcoin, for example, is famously capped at 21 million coins.

- Characteristics

- Scarcity: The capped supply can create a perception of rarity.

- Predictability: Because the issuance schedule is often transparent, holders can anticipate when new tokens will enter circulation (if any are still mined or minted).

- Potential Volatility: With fewer tokens available, increased demand can push prices rapidly, but the reverse can also be true in bearish conditions.

- Advantages

- Store of Value: Many view fixed-supply tokens as “digital gold.”

- Simplicity: It is easier for newcomers to grasp how many tokens exist and when the cap will be reached.

- Price Appreciation Potential: Limited supply can spur significant price gains if demand grows.

- Disadvantages

- Limited Incentives: Harder to continuously reward participants (e.g., stakers, miners, or content creators) without a dedicated reward or inflation mechanism.

- Possible High Volatility: Scarcity can lead to significant price swings with changing market sentiment.

2. Inflationary Supply

In an inflationary model, new tokens are continuously created over time. This could happen via block rewards, staking rewards, or other mechanisms embedded in the token’s smart contract.

- Characteristics

- Ongoing Minting: A set number of tokens are added at fixed intervals or as participant rewards.

- Economic Incentives: Staking or validating transactions can be lucrative, attracting users who want to earn yield.

- Token Value Challenge: Prices can suffer if new tokens flood the market faster than demand grows.

- Advantages

- Rewards for Participation: An inflationary model can sustain long-term incentives for stakers, validators, and other contributors.

- Community Engagement: Steady token issuance encourages ongoing community involvement, as users must “work” to earn new tokens.

- Flexible Economic Design: Developers can fine-tune the inflation rate or reward distribution as the project evolves.

- Disadvantages

- Risk of Dilution: Existing holders may see their stakes diluted if new tokens outpace adoption.

- Complex Tokenomics: Explaining an ongoing minting model to newcomers can be more complicated, potentially affecting marketing and user understanding.

3. Hybrid Supply

Hybrid models combine elements of both fixed and inflationary designs. For instance, a token might start inflationary for several years to bootstrap growth (through staking rewards) and later switch to a fixed-supply or deflationary phase with periodic token burns.

- Characteristics

- Adaptive Supply: The supply can be adjusted based on community needs or project milestones.

- Phased Approach: Projects can reward early adopters and then pivot toward scarcity.

- Complex Governance: Often requires robust on-chain governance to decide when and how supply parameters change.

- Advantages

- Flexibility: The project can respond to market conditions, community feedback, or technology upgrades.

- Incentive + Scarcity: Early participants earn rewards, but long-term tokenomics still aim to preserve or increase value through capped or deflationary measures.

- Innovation: Encourages creative mechanisms like “halvenings,” buybacks, or controlled burns.

- Disadvantages

- Complicated to Communicate: Unless clearly explained, this may confuse first-time users or investors.

- Governance Tensions: Ongoing debate about how and when to modify supply can cause community disagreements.

How Supply Models Affect Token Value

The supply model you choose is intimately linked to how the market perceives your token’s value:

- Scarcity vs. Abundance

- Fixed Supply: Markets often react positively to scarcity, driving speculative price growth.

- Inflationary Supply: If well managed, it can stabilize or gradually increase token prices, but poorly controlled inflation risks devaluation.

- Market Psychology

- A token branded as “the next digital gold” can attract long-term holders.

- A token that promises continuous staking rewards may appeal to yield seekers, especially in decentralized finance (DeFi).

- Volatility

- Tokens with a fixed supply can see rapid price spikes and drops if demand changes.

- Inflationary tokens can experience downward pressure if new tokens are created without a corresponding rise in demand.

- Utility Over Speculation

- Ultimately, real utility—governance power, access to premium features, or cross-platform functionality—can anchor a token’s value beyond supply constraints.

How Supply Models Influence Adoption

Beyond price, supply models shape how quickly and profoundly users adopt a token:

- Reward Mechanisms

- Inflationary or hybrid models often incorporate staking or block rewards. These “earning” opportunities can spark community interest and attract user participation.

- Fixed supply tokens might rely on a “hold” mindset or a specialized utility (e.g., governance rights in a DAO).

- Community Engagement

- Projects that continuously distribute new tokens to active users tend to foster higher engagement, as it gives a consistent incentive to remain involved.

- Fixed supply projects often rely on strong marketing narratives around scarcity, focusing on brand loyalty and future value appreciation.

- Developer Ecosystem

- Inflationary tokens can pay developers (or node validators) from newly minted tokens, sustaining an active developer community.

- To incentivize developers, fixed-supply tokens may need alternative funding mechanisms, such as grants or revenue from products or services.

- Network Effects

- The more prominent and active the community, the more utility the token may have (especially for governance, marketplace transactions, or bridging in DeFi). A well-chosen supply model can speed up community-led expansion.

Real-World Examples: From Bitcoin to Binance Coin

Examining real-world projects helps illustrate how different supply models play out in practice.

- Bitcoin (Fixed Supply)

- Supply Cap: 21 million BTC.

- Mechanism: Block rewards halve every ~4 years, reducing the rate at which new BTC enters circulation.

- Effect: Bitcoin’s scarcity narrative made it the most recognized crypto asset, often compared to “digital gold.” However, its fixed supply has also contributed to sharp price volatility.

- Polkadot (Inflationary)

- Supply Model: Continuous issuance to reward validators.

- Effect: Polkadot’s staking incentives encourage a robust network of node operators, fostering decentralized security and active governance. However, the inflation rate demands ongoing user growth to prevent price dilution.

- Binance Coin (BNB) – Hybrid

- Supply Model: Starting with a set supply, Binance conducts periodic token burns to reduce circulation.

- Effect: By rewarding early adopters with a dynamic token structure and implementing burns, BNB maintains utility (for transaction fees, launchpad investments, etc.) while incorporating deflationary pressure over time.

These examples highlight that no single supply model is “best.” The choice depends on project goals, user demographics, and the long-term vision.

Choosing the Right Supply Model for Your Web3 Project

If you’re part of a Web3 marketing agency or founding a blockchain project, here are key questions to guide your decision:

- What Is the Main Use Case?

- A fixed supply could make sense if your token is primarily a store of value (akin to digital gold).

- An inflationary or hybrid approach might fit better if you need ongoing rewards to keep people engaged.

- Who Is Your Target Audience?

- Long-term Investors Tend to prefer scarcity for potential price appreciation.

- Active Participants/Builders: May value reward-based models (inflationary/hybrid).

- How Complex Can Your Tokenomics Be?

- A purely fixed model is more straightforward to explain.

- Hybrid or inflationary models may require more education—but also allow more dynamic community incentives.

- Regulatory and Legal Considerations

- Different jurisdictions have varying definitions around tokens, mainly if they’re classified as securities.

- Work with legal professionals to ensure your supply model doesn’t violate regulations.

- Future Adjustments

- Are you willing to pivot from inflationary to fixed or vice versa?

- If yes, you may need a robust governance framework or code-based triggers to handle such changes.

Best Practices for Distribution and Community Building

No matter which supply model you choose, distribution and community engagement are critical:

- Fair Launch

- Ensure no single entity holds an excessive share. This can be done through broad-based token sales, airdrops, or mining incentives.

- Transparent Vesting

- If you have team tokens, lock them in a vesting schedule to avoid public mistrust or massive sell-offs.

- Multi-Channel Communication

- Maintain active Discord, Telegram, and Twitter channels. Conduct AMAs (Ask Me Anything) to answer community questions about supply and token design.

- Educational Materials

- Create easy-to-understand whitepapers, litepapers, or FAQs that explain your supply model and tokenomics.

- Consider adding infographics or flowcharts that show how tokens move through the ecosystem.

- Incentive Campaigns

- For inflationary or hybrid models, consider liquidity mining campaigns or staking rewards.

- For fixed supply, promote scarcity-based events—such as “limited-time” NFT drops or token buybacks—to keep excitement high.

Practical Tokenomics: Balancing Supply, Demand, and Utility

While supply is crucial, it’s only one piece of the puzzle. Real-world success hinges on balancing supply with:

- Demand Drivers

- Offer compelling reasons to hold or use the token: governance, platform access, or DeFi yields.

- Utility

- The more functional your token is—for voting, payments, or gating premium content—the easier it is to sustain demand.

- Community & Brand

- A strong brand narrative and an engaged user base can mitigate short-term market fluctuations.

- Foster loyalty with consistent updates, community events, and transparent leadership.

- Market Listings & Liquidity

- Listing your token on decentralized and/or centralized exchanges ensures it is liquid. Liquidity can stabilize prices and improve user experience.

- Evolving Governance

- Some projects let token holders vote on supply-related changes, fostering a democratic approach to tokenomics.

- This can be powerful but requires careful planning to avoid hasty or exploitative governance proposals.

Conclusion

Token supply models are at the heart of any successful cryptocurrency or blockchain project. For Web3 marketing agencies and teams building token-based ecosystems, understanding the trade-offs between fixed, inflationary, and hybrid supply is paramount. Each model has implications for value, adoption, and community engagement, and none is universally “best.”

- Fixed Supply tokens thrive on scarcity and appeal to long-term holders seeking “digital gold.”

- Inflationary models incentivize continuous user participation but risk diluting value if inflation isn’t balanced by strong demand.

- Hybrid models aim to marry the best of both worlds, offering flexibility and dynamic incentives.

Ultimately, the right choice depends on your project’s mission, target audience, regulatory environment, and roadmap. Communicating your supply model transparently—via educational content, active community channels, and consistent updates—can help you cultivate a loyal community that not only holds your tokens but actively participates in your project’s growth.

Armed with a well-thought-out supply strategy and effective tokenomics, your token can evolve from another digital asset to a cornerstone of user engagement and community loyalty in the expanding Web3 universe.

Disclaimer: This blog is for informational purposes only and does not constitute financial or investment advice. Always do your own research and consult professionals before making any significant financial decisions. - Scarcity vs. Abundance